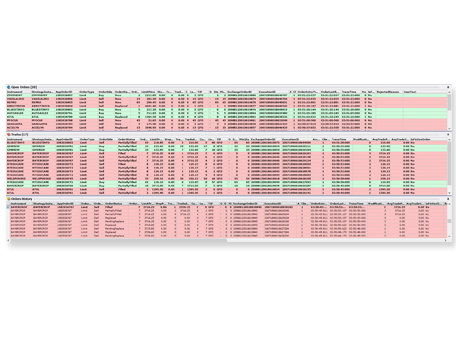

BlitzTrader OMS offers necessary functionality to manage positions, order management workflows, trading compliances in real-time across different asset-class and instruments. It helps provides order placement, executions, trade processing and position management ensuring the flexibility you need to manage your sophisticated algorithmic trading needs with access of real-time positions/P&L. It is fully integrated with market data feed to manage risk in real-time.

BlitzTrader OMS is designed to handle trade positions and statistics at strategies, instrument and account level managing operational efficiency and very detail risk control on your overall portfolio. The system seamlessly integrate with exchange adapters one side and trading decision process on the other side to quickly and confidently manage trading decision. Additionally, BlitzTrader OMS solutions with scalable architecture and high volume execution capabilities can be fully incorporated with any of our analytical, algorithmic trading and risk management products.

Order Management System

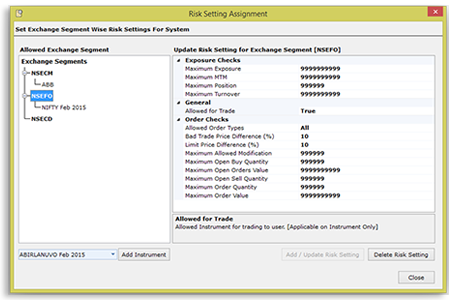

Risk Management

Risk management plays an important part in determining your trading success. The BlitzTrader Risk Management has been designed and implemented to meet outlined regulatory requirement of exchanges and sell side institutions. It supports the management of the financial, regulatory requirements, pre-trade risk validation and other risks associated with market access; it monitors the order flow for orders that violate of the clients’ established guidelines, policies, and positions and equity limits before routing the orders to the market centers for execution.

Some of pre-trade risk rule associated with BlitzTrader server is

- Maximum Orders Size Limit

- Maximum order value Limit

- Maximum Position Size Limit

- Price range check

- Trade price protection

- Market price protection

- Automated execution and message throttle limit

- Cumulative open order quantity

- Turnover Limit

- Maximum Loss per Account