Scalable, low latency, high performance architecture

Scalable, low latency, high performance architecture

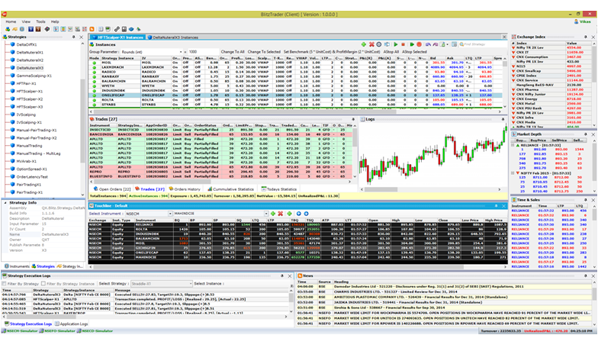

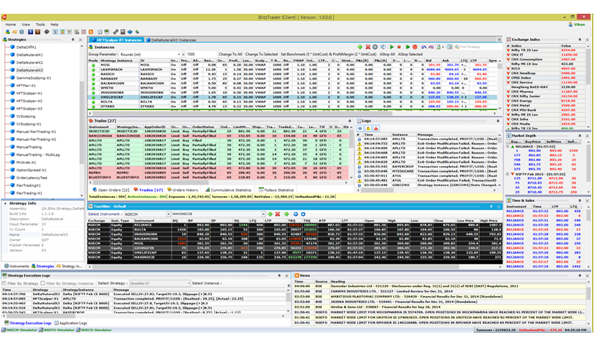

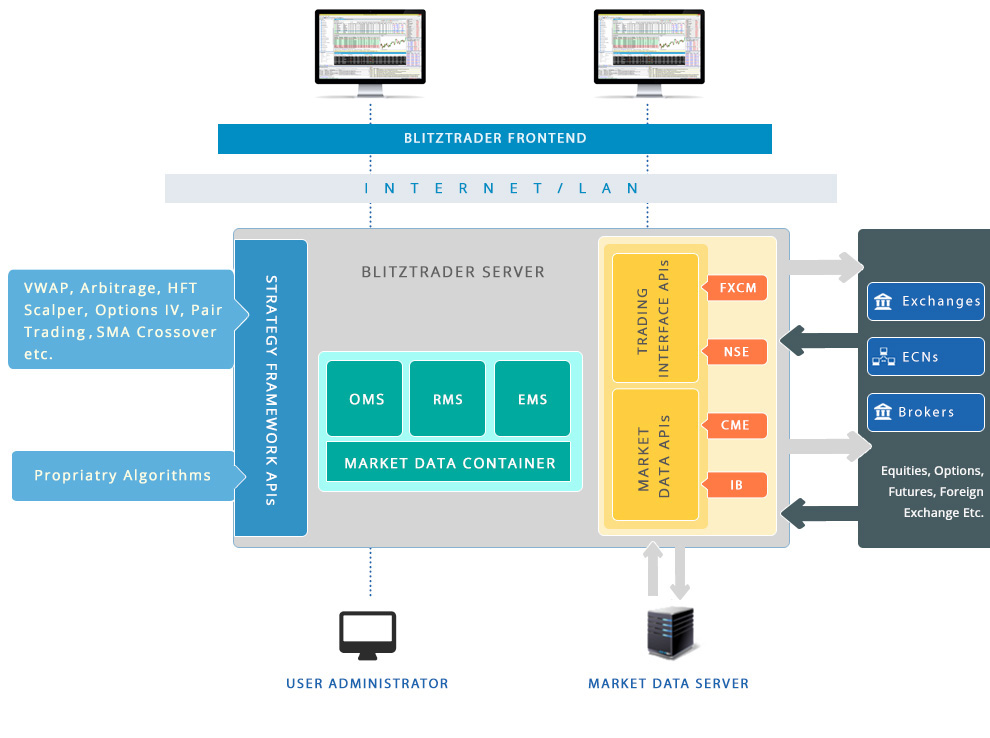

In a business environment where microseconds matter, BlitzTrader platform efficiently to carry out transactions with the quality execution price, speed and precision trader expect and demand, giving you competitive advantage and improving your bottom line. The system multi-threaded architecture takes full advantage of muti-core CPU server to provide a scalable and cost effective way to implement low latency algorithmic trading strategies in co-location setup. The system is designed to run hundreds of strategies in muti-market scenario with microseconds execution to capitalize most from BlitzTrader.

Alpha Generation with Straight through Processing

Alpha Generation with Straight through Processing

BlitzTrader provides seamless and efficient straight-through-processing covering entire trade life cycle with sophisticated framework for alpha generation to meet the requirements of traders in this new technology driven marketplace. The BlitzTrader straight through processing enables complete automation, increase efficiency, risk control of your entire real-time trading workflow with integrated global market data.

Open Trading Framework and API

Open Trading Framework and API

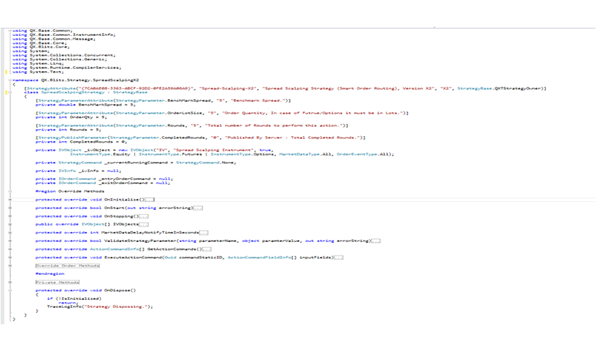

BlitzTrader is built with open architecture philosophy with flexibility to trader specific customization and easy-to-manage developer tools to fully extend platforms and trading workflows to meet your unique needs. With powerful API model system enables you to rapidly develop, test and deploy your proprietary, complex algorithmic trading strategies, writing connectors to markets/brokers for order execution and customize the user interface as powerful you wants. The system infrastructure provides access of live and historical market data. The open interface allows system to easily integrate with third-party applications like Matlab, Excel, Amibroker, Metatrader etc.

Most home grown trading system is often a piecemeal application from different vendors that are not made to work together out of the box. BlitzTrader enterprise level feature with open and flexible API model saved you from time and resources it takes to build trading solutions from the ground up meeting all your unique automated trading needs and address the challenges of continuous evolving financial marketplace.

BlitzTrader API is built on top of Microsoft .NET platform, so strategies can be developed in any .NET supported language (C#, VB.NET, C++, J#...) and is fully integrated with Visual Studio platform through a set of ready-to-go templates. The platform efficiently leverages the Scalability, enhanced performance and throughput from latest hardware with multi-core and multi-threaded architecture.

Rapid algorithm development; with fast time to the market

Rapid algorithm development; with fast time to the market

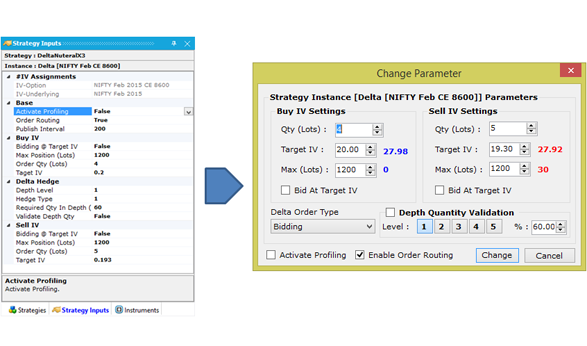

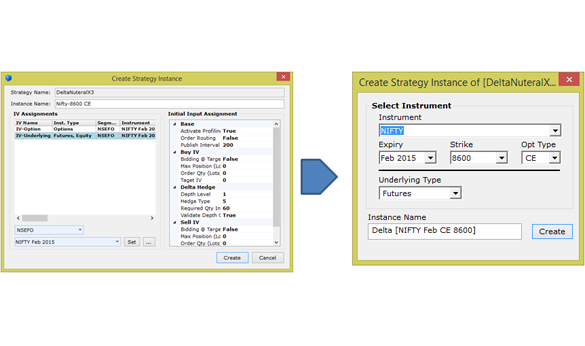

BlitzTrader enables quant developer to bring new production ready strategies in days rather than weeks or months and leverage API models to quickly build, test and deploy low latency algorithmic trading strategies. The goal is to provide a simplified, high performance and scalable end-to-end trading system platform, best to meet your trading goal and reduce time to market your proprietary trading ideas.

Low Latency Server based Execution

Low Latency Server based Execution

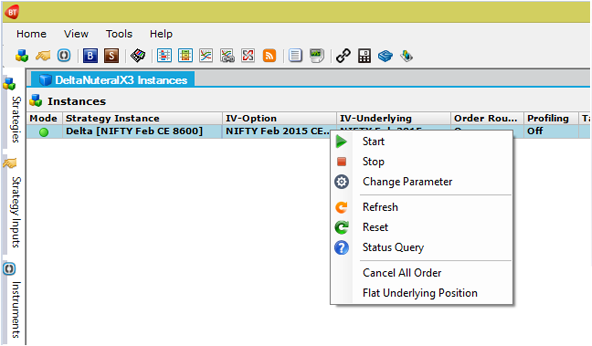

Server based strategy executions provides capability to host your trading strategies directly to the proximity of the exchanges that significantly reduce time to execution as well as risk of multiple point failure.

Multi market connectivity

Multi market connectivity

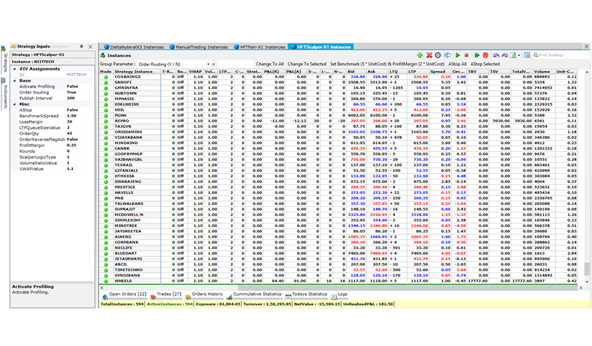

Traders can capitalize algorithmic trading opportunities across multiple markets with any combination of asset class. BlitzTrader provides a flexible framework and API model to develop and deploy new market connectivity as an adapter plug-in to the system. The BlitzTrader also provide a FIX Engine Connectivity API to rapidly develop new FIX based market adapters. Muti market connectivity enables powerful way of executing statistical arbitrage strategies across global market.

Broker agnostic and Asset neutral

Broker agnostic and Asset neutral

BlitzTrader broker agnostic architecture ensures quants and developers to trade market of their choice and scale opportunities to new markets. Market connectivity APIs allows developer to quickly develop trading and market adapters of new exchange or broker system. The system provides cross-asset execution and is capable to model and trade your strategies in global equities, options, futures and forex markets. The system is flexible to support all native exchange orders i.e. spread and multileg order to be directly used from trading strategies.

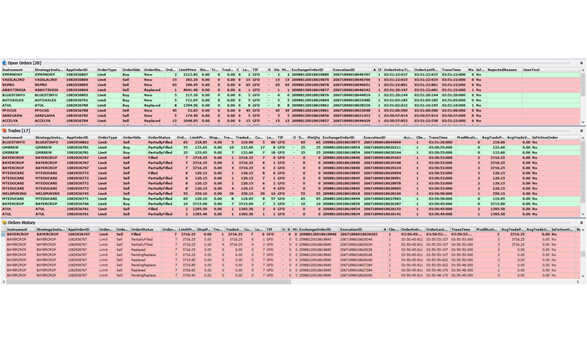

OMS and Risk Management System

OMS and Risk Management System

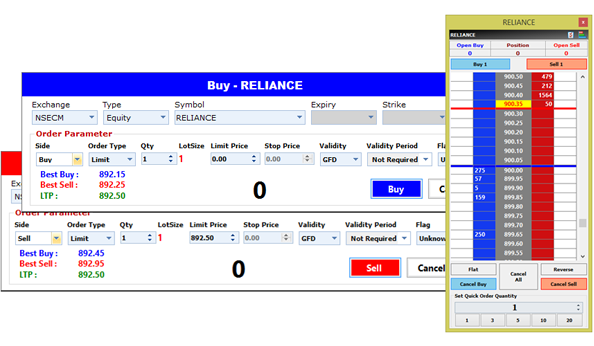

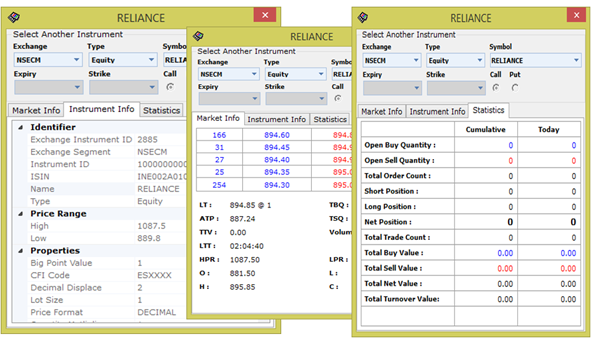

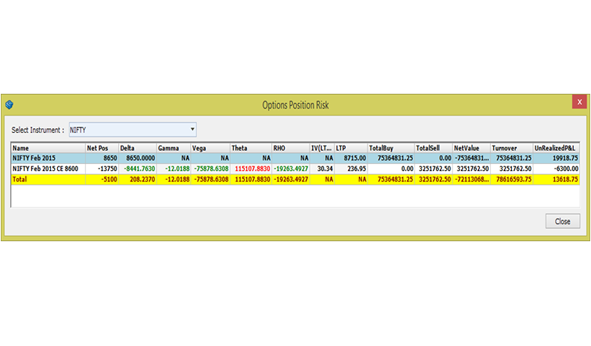

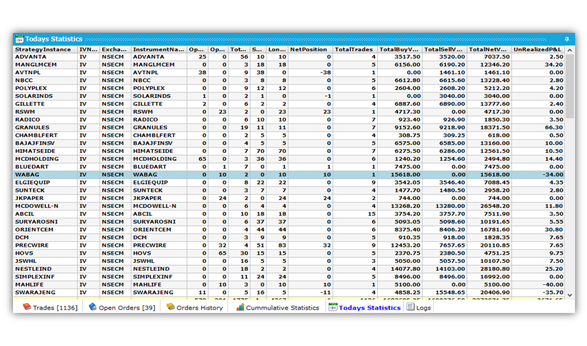

BlitzTrader OMS and Risk management modules is an in-built systems which provides comprehensive access of trade positions, open profit and loss, other statistics to access and control the financial state of the system at strategy, user and portfolio level. Risk management component is based on comprehensive quantitative and financial limits, which allows users to set trading limits, validated before sending each order to the trading systems.

Simulation with live or recorded market data

Simulation with live or recorded market data

BlitzTrader provides in built simulator designed to let you test your trading strategies without risking any real money and check the statistical performance and execution logic before system goes in production. The trading simulation can be tested against recorded or live production market data.

Market Variable and Smart Order Concept

Market Variable and Smart Order Concept

Strategy development API provides market agnostic programming variables to develop quantitative arbitrage strategies across different market and asset class.

HFT strategies like market making, statistical arbitrage demands consistently placing of new limit orders, modifying it several time and cancelling it in case opportunity ceases out. Smart Order command manages all operations transparently with a single order command which makes strategy development more robust with less development time. Order command automatically managesthe state of orders and not route any actions if it is in a transient state. Many more powerfulconcepts in BlitzTrader API make quantitative strategy development process very easier.

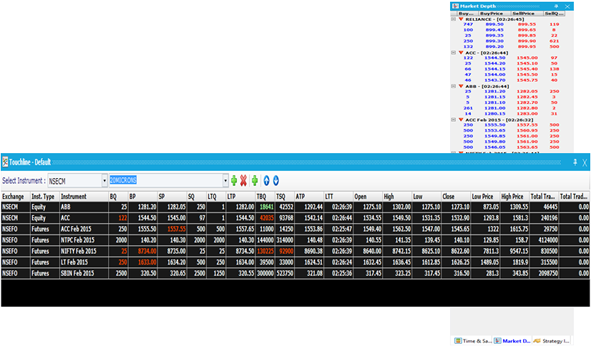

Market Data Server

Market Data Server

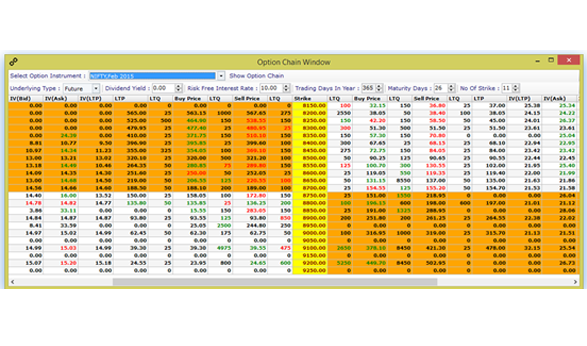

BlitzTrader offers an unified direct exchange market data feed handler solution to capture, normalize, enrich, store and disseminate market data with lowest possible latency. Its market data component captures real-time normalized market data from feed handlers, process and store to make it available for immediate or subsequent analysis. The data is stored in standard OHLCV (Open/High/Low/Close/Volume) bars and Tick time series. The bars can be created based on any prices information i.e. LTP, BID, ASK, MIDPRICE. QXMDS is also capable to store options contract implied volatility market information. QXMDS allows trading applications to retrieve and sync historical bar with real-time bar for strategy analysis and to generate trade signals based on your strategies rule. QXMDS provides API to access any time compression series data.

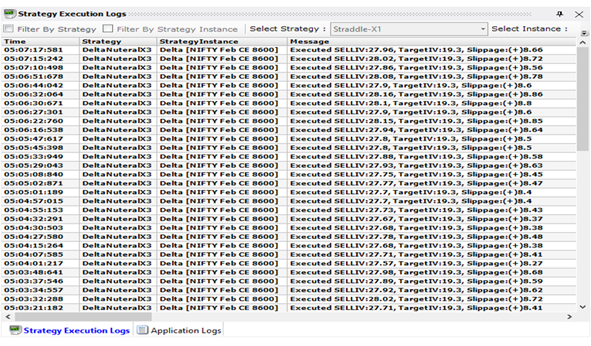

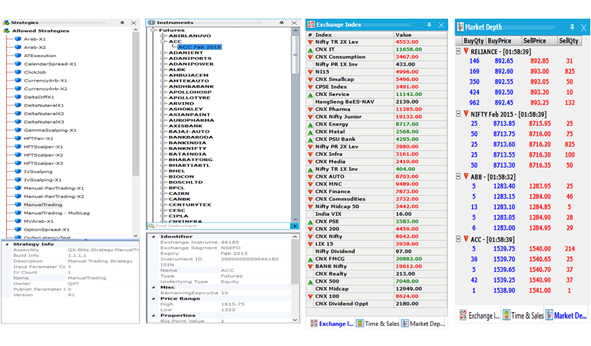

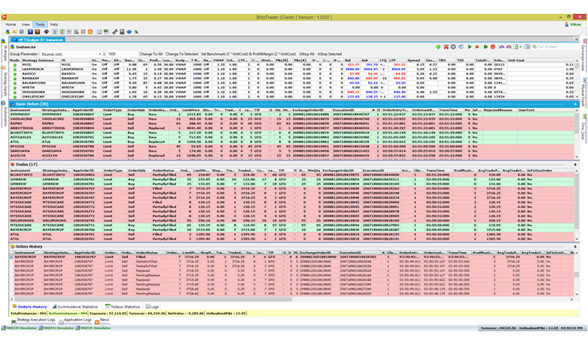

Rich Trading Blotter interface & Custom trading interface design

Rich Trading Blotter interface & Custom trading interface design

The BlitrzTrader Blotter interface has powerful, innovative features with open architecture to extend visual interface and is highly customizable to accommodate any new requirements. Traders used to monitor and act on automatic trading activities from strategies hosted on server side and view market prices, order management state, trading statistics, positions etc. in real time. BlitzTrader Trading interface API and open system architecture enables programmer to use Microsoft.NET based programming language for rapid creation and customization of powerful visual interface, trading features and tools to interact with server side hosted strategies.

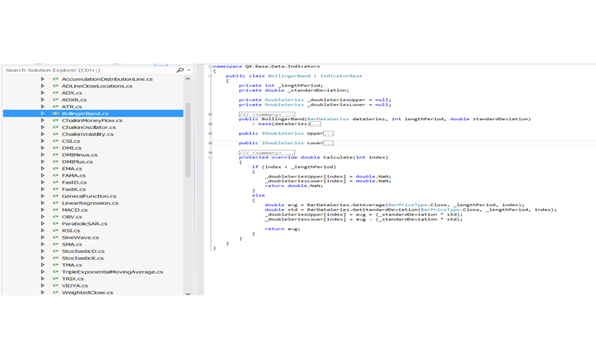

Rich set of Technical analysis and Options analytics library

Rich set of Technical analysis and Options analytics library

BlitzTrader API model provides comprehensive framework and a rich set of technical analysis and options analytics library to build quantitative trading models in an easy way. The options analytics and strategy development framework provides advanced analytics and market leading algorithms to automate single or multileg options strategies.

News and event based trading

News and event based trading

With the growing role of news in trading automation; the BlitzTrader open framework allows clients to easily incorporate live machine readable news feed with variety of trading strategies to seize new opportunities with managed risk.

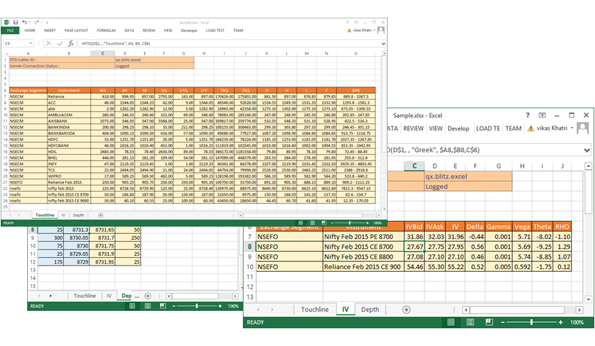

RTD Add-ins and Excel Integration

RTD Add-ins and Excel Integration

BlitzTrader provides enhanced RTD add-on service that makes it quick and simple to download real-time, market data and options Greeks into your Excel worksheets. The data is fully streaming and no refresh is required. Through combination of BlitzTrader and Excel provides a powerful analysis platform for traders and enables to create a highly customize application designed to your specific needs.

Enterprise wide administration

Enterprise wide administration

The BlitzTrader provides a centralized monitor, full control and action on all activities related to trading session, access rights, connectivity, strategy permission and risk management.

Scalable, low latency, high performance architecture

Scalable, low latency, high performance architecture Open Trading Framework and API

Open Trading Framework and API Rapid algorithm development; with fast time to the market

Rapid algorithm development; with fast time to the market Low Latency Server based Execution

Low Latency Server based Execution Multi market connectivity

Multi market connectivity Broker agnostic and Asset neutral

Broker agnostic and Asset neutral OMS and Risk Management System

OMS and Risk Management System Simulation with live or recorded market data

Simulation with live or recorded market data Market Variable and Smart Order Concept

Market Variable and Smart Order Concept Market Data Server

Market Data Server  Rich Trading Blotter interface & Custom trading interface design

Rich Trading Blotter interface & Custom trading interface design News and event based trading

News and event based trading RTD Add-ins and Excel Integration

RTD Add-ins and Excel Integration