As the speed and volume of market data continues to soar, staying ahead of the competition requires high performance, scalable infrastructure for the processing of data and delivered it via low latency feed to exploit the best trading and execution opportunities in the market. A comprehensible and reliable market data is fundamental to trading and for trading styles including HFT, arbitrage and market making, delivery of market data needs to be at the lowest latency possible.

We enable users to add new market connectivity and integrate market, machine readable news and reference data information into trading infrastructure rapidly and easily.

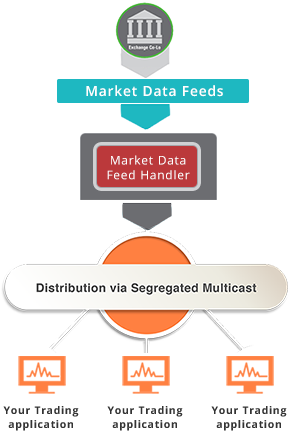

QuantXpress offers a unified direct exchange market data feed handler solution to capture, normalize, enrich, store and disseminate market data with lowest possible latency that simultaneously manages direct connectivity across equities, options, futures and FX exchange feeds. QX Market Data Server is an ultra low-latency solution for high volume and latency-sensitive markets. Its low-latency full-tick feeds, direct from exchanges, are ideal for algorithmic trading programs and other high-speed machine-trading applications.

The feed handler application can also replay the data in the same format as was provided in real-time. This functionality allows users to forward test their trading strategies on recorded market data.

Low Latency Market Data Feed Handler

The QX feed handler extract market data from network stream and decode it. Decoded information is used low latency algorithms to create and process an order book.

Market Data Normalization

The respective feed handler decode the market data received in exchange proprietary binary format, FIX/FAST and normalized to our standard easy to use common binary format which can be access via our API .

Market Data Distribution

Real-time data feeds are normalized and consolidated into one consistent format. Exchange feed handlers capture directly the data from exchange or market data source and disseminate normalized market data to trading applications through an easy to use low-latency API which enables trading applications to quickly and cost effectively integrate market data across all asset-class.

Market Data Server

(Market data on demand)

QXMDS captures real-time normalized market data from feed handlers through multicast channel, process and store to make it available for immediate or subsequent analysis. The data is stored in standard OHLCV (Open/High/Low/Close/Volume) bars. QXMDS allows trading applications to retrieve and sync historical bar with real-time bar for strategy analysis and to generate trade signals. QXMDS provides API to access any time compression series data.

QXMDS captures real-time normalized market data from feed handlers through multicast channel, process and store to make it available for immediate or subsequent analysis. The data is stored in standard OHLCV (Open/High/Low/Close/Volume) bars. QXMDS allows trading applications to retrieve and sync historical bar with real-time bar for strategy analysis and to generate trade signals. QXMDS provides API to access any time compression series data.

QXMDS is also part of BlitzTrader offering to provide traders to develop and deploy time series and technical indicator based strategies. QXMDS API provides its caller the normalized view of market.

Blitz strategy can access real-time time series in sync with historical data as following:

private IVObject _iv = new IVObject("CMESymbol", "CME symbol", true,

InstrumentType.Futures,

MarketDataType.All,

OrderEventType.All);

int barSize = 1;

IVMinuteBarDataSeries barDataSeries = GetMinuteBarDataSeries(_iv,

IVBarType.LTP, barSize,

DateTime.Today.AddDays(-5),

out errorString);

_barDataSeries.OnBarCompleted += IVOnBarCompleted;

private void F1Buy_ IVOnBarCompleted (IBarData barData)

{

TraceLogInfo(string.Format("Bar Completed : [{0}|{1}|{2}|{3}]",

barData.BarOpen,

barData.BarHigh,

barData.BarLow,

barData.BarClose));

}